Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

So bearish on all the founders and other stakeholders who think in terms of "this should belong to equity."

Every founder who allows that conflict of interest is essentially fine with having incentives that will destroy their project for some short-term opportunity. The moment you go for SAFE + TW and your project has a TGE, you end up with two different cap tables.

@JeffBezos would call this mistake a one-way door—a decision you can’t reverse. Be aggressive with two-way doors, but don’t be naive with one-way doors.

The only way to manage this is to accept that if you are in crypto and launching a token (you don’t have to), that’s your value accrual mechanism. You will be able to tell your early investors who received a warrant that everything is owned by the token, but you will not be able to say this the other way around to the public market in the future.

This doesn’t mean you can’t use revenue for growth, or that you must immediately buy back and burn it. If you burn, it’s no longer an asset on your balance sheet. And if you’re a startup, it often doesn’t make sense to use the little cash flow you have to buy back tokens instead of growing.

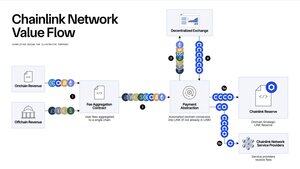

For all the founders who are trying to get cash flows from the real world and just use the token for growth—but then tell me afterwards that the cash flow is equity-owned—take a look at @chainlink

Also take a look at what @Morpho and @ethena_labs are doing.

All those chads will win way bigger

26,63K

Johtavat

Rankkaus

Suosikit