Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

The rich don't hide money, they hide ownership

A $100 million luxury home? Registered under the name of a shell company

A $500 million yacht? Trust institutions belonging to Panama, what cash? It was the foundation that hired them to spend it.

How the super-rich made tens of millions of assets disappear and why no one can stop them: 🧵

Please click to follow, favorite, and bookmark

Follow my channel!

#gmgn On-chain dog rushing tools, monitoring, trading, smart money must-haves, first choice

#Binance 300 million users, the first exchange

#OKX One web3 entry is enough:

Article from Finance_Nerd_

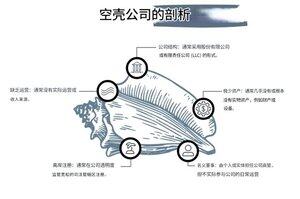

First of all, what is a shell company?

A shell company is a company that exists legally but has no actual business operations.

It has no employees, no operations, and no office.

Its purpose is:

To hold assets without exposing the true owners.

For super-rich individuals, it is simply tailor-made.

Why use a shell company?

Because once you own it, it means you may have to bear legal responsibilities.

Through a shell company, they can achieve the following:

• The mansion is not owned by you, but by the company.

• The profits are not earned by you, but by the shell company.

• Your name does not appear on the documents; instead, it’s the name of the nominee.

You still control these assets, but your identity is completely off the table.

The rich will package shell companies layer by layer like Russian nesting dolls.

For example:

• Company A is a shell company that holds an apartment

• Company A is owned by shell company B

• Company B belongs to a trust

• The trust is controlled by a foundation

• The registered head of the foundation is an agent, not the actual owner

This sets up 5 layers of legal defenses.

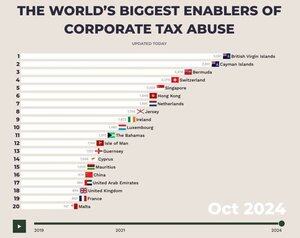

Where are these shell companies located?

Usually in places with information confidentiality and loose regulations, such as:

• British Virgin Islands

• Delaware, USA

• Wyoming, USA

• Panama

• Seychelles

These regions do not inquire about who owns the company; they just help you register and ensure your privacy.

How does it make hundreds of millions of dollars "disappear"?

A billionaire transfers his company's profits to a shell company in the Cayman Islands;

This shell company then invests the money into a trust;

The trust donates the funds to a foundation;

Finally, the foundation hires this billionaire as a consultant and pays him a fee.

Thus, he turns this money into tax-free income.

Countries are trying to legislate to close these loopholes:

• The U.S. enacted the Corporate Transparency Act in 2021, requiring companies to disclose the true beneficial ownership information;

• The EU has begun to mandate the establishment of a corporate ownership registration system;

• The Organization for Economic Cooperation and Development (OECD) is also promoting a global standard for financial information disclosure.

But the problem is: super-rich individuals are always two steps ahead.

4,47K

Johtavat

Rankkaus

Suosikit