Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

"Wait, will @0xfluid overtake @Uniswap in volume by EOY?"

🧵

II. Launched in 2018, @Uniswap pioneered the Automated Market Maker (AMM) approach, replacing order books with liquidity pools and processing over $3T in volume to date.

"Hmm, but its reign is not secure, right?"

III. Well, @Uniswap's dominance is built on innovation, but its architecture has two weaknesses:

- Liquidity fragmentation: liquidity is split across V2, V3, and V4, a.k.a. weakening its core strength.

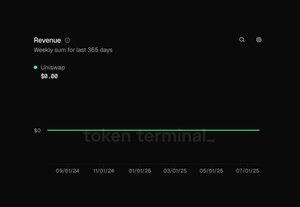

- $0 revenue: @Uniswap lacks a native economic engine to fund its own growth.

IV. @0xfluid's answer is its liquidity layer: a single, unified capital pool.

Unlike @Uniswap's "islands," all of @0xfluid's applications (DEX, lending) draw from the same deep pool, compounding liquidity with each new feature.

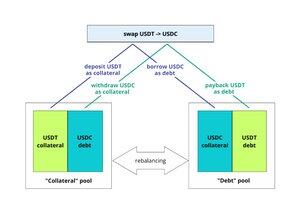

V. With "Smart Collateral" and "Smart Debt," users can lend assets while simultaneously using both their collateral and debt as fee-earning DEX liquidity.

Capital serves a dual purpose.

VI. A user's initial capital can be leveraged to provide liquidity far exceeding the initial deposit.

"What's the result?"

$1 in TVL can generate up to $39 in effective DEX liquidity. This is @0xfluid's architectural cheat code.

VII. The ultimate consequence of this hyper-efficiency is an almost irresistible economic incentive: net-negative borrowing rates.

"Hmm?"

When trading fees exceed loan interest, users are essentially paid to borrow.

VIII. "Isn't it just a theory?"

No, @0xfluid recently hit $1B in 24h volume and became the #2 DEX on @ethereum by daily volume.

IX. Additionally, @0xfluid features a built-in revenue engine that captures a portion of fees to fuel its growth.

This allows it to support aggressive incentives and token buybacks, an approach that @Uniswap's passive, $0-revenue model can't readily counter without a slow and contentious governance vote.

X. Behind @0xfluid is the battle-tested team from @Instadapp, known for their proven track record in building secure DeFi products and managing over $2.8B in TVL at their peak.

This isn't a new team; it's a team of DeFi chads.

What do you, bois, think of @0xfluid?

@splinter0n @0xDefiLeo @the_smart_ape @0xCheeezzyyyy @DOLAK1NG @YashasEdu @0xAndrewMoh @eli5_defi @_SmokinTed @RubiksWeb3hub @kenodnb @lstmaximalist

I hope you've found this thread helpful.

Follow me @belizardd for more.

Like/Repost the quote below if you can:

22,53K

Johtavat

Rankkaus

Suosikit