Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

ALERT的会所

Fans are long $TREE explode 8w knife:

The tree that fans are 0.68 long has been making up for the position, and now it is 0.44, which has exploded 8w.

His own thoughts are:

Brother Suo is 1.2 knives short, the airdrop selling pressure is over, and the project will pull the market if it is very good. His liquidation was because the position was not well controlled.

To be honest, this fan is relatively calm, it is estimated that 8w is not impressed by him, and he still insists on reviewing every transaction.

I asked him what he thought was good about $TREE, and he thought it was the native yield of ETH.

His source is the investment research articles posted by many KOLs, and he probably judged what the tree is doing, and the narrative is okay.

I asked him: What is the reason why tree attracts ETH owners to obtain native income? If not, then where is the value of the tree protocol?

Putting aside the conspiracy theory logic of bankers, DeFi projects that return to value itself are easy to calculate.

The yield of 3% can surpass the income of ETH staking, which is not as good as the delta neutrality of @okxchinese staking + fee rate.

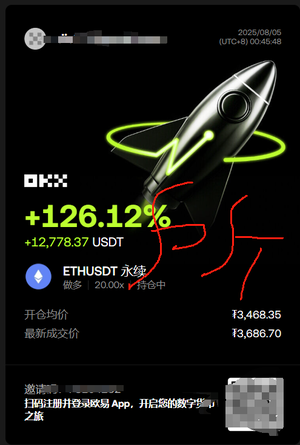

Such a valuation range is easy to calculate, which is the biggest reason for me to short 1.2 at the beginning, as shown in the figure.

The reason why you lose money is that there is no stop loss, and this reason is not operable.

Only with transaction expectations can there be a basis for operation.

Share.

25,88K

At present, the $eth list has returned to 3462.

Many group members were trapped on Twitter, looking at 4,000 when they saw it rising, and 3,000 when they fell.

Or just look at the decimal point of the non-farm payroll data downward, and feel that the macro is bad.

Then pick a KOL at random, see how much he opens, and follow him.

This kind of group of friends can't be saved.

I trade according to expectations, and if I make a mistake in the prediction judgment, I will stop the loss, and I will never open it because others open it, I will open:

The so-called support and pressure levels are not data, but the degree of sufficient chips accumulated to make the divergence digestible.

Macro staging in interest rate cut transactions and recession trades, as well as the extension of credibility brought by the replacement of the Department of Labor.

Therefore, the basis of this order is:

The gap was filled

Non-farm payrolls guide interest rate cut expectations, and forward treasury bonds support a weak consensus recession

If you are optimistic, Trump will taco again tonight

On a pessimistic note, the credibility of the US dollar on Monday triggered a pullback in US dollar assets.

31,07K

Johtavat

Rankkaus

Suosikit

Ketjussa trendaava

Trendaa X:ssä

Viimeisimmät suosituimmat rahoitukset

Merkittävin