Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Featured Indicators: Altcoin Alpha

The Research team created four Featured Indicators to level up your market insight:

- Retail Activity (via Trading Frequency)

- Average Order Size

- Volume Bubble Map

- Taker CVD

Here’s how to use them effectively 👇

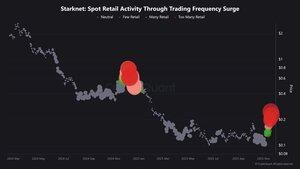

Retail Activity via Trading Frequency

Tracks how active retail investors are by measuring trade count. It’s relative (adjusted by 1-year moving average) to factor in user growth.

The indicator is useful for spotting frothy tops.

Example: Starknet ($STRK) peaked in late 2024 amid a surge in retail activity — and it’s flashing similar signals again.

Average Order Size

This metric is calculated by dividing total volume by number of trades — higher values = more whale activity. Useful for identifying key price zones where whales are active.

Example: $HYPE exhibited large order sizes in April 2025 before rallying from ~$11 to $60.

Now? Big whale orders again.

Volume Bubble Map

This indicator visualizes trading volume trends using bubbles:

- Bubble size = trading volume.

- Color = volume trend

In late-stage bull markets, high volume + weak price action = Distribution Phase, where early holders sell to new entrants.

Example: Solana has formed multiple bottoms during the Cooling phase, while Overheating phases are often aligned with distribution tops.

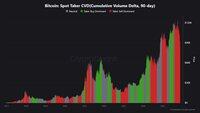

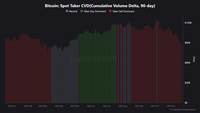

Taker Cumulative Volume Delta (90-Days)

This indicator tracks the net pressure between market buys and sells over 90 days.

It accumulates the difference between Taker Buy and Taker Sell volume:

📈 Positive & rising → Taker Buy Dominant

📉 Negative & falling → Taker Sell Dominant

Example: Spot Taker CVD for Bitcoin turned bearish around $117K — it’s now trading near $81K.

12.24K

Top

Ranking

Favorites