Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Shanaka Anslem Perera ⚡

⚡️ Bitcoin maxi | Hashrate disciple | Compressing fiat entropy into 21 M sats | Proof-of-Work zealot | Stacking, hodling, spreading hard-money gospel

HINDENBURG'S INFERNO IGNITES: THE AI BUBBLE'S FATAL CRACK

A silent alarm just shattered the illusion of stability. The Hindenburg Omen, the market's most feared breadth divergence signal, has triggered a confirmed cluster on October 17 and October 30, 2025. This is not a drill. This is the precise fracture that preceded 1987's Black Monday, the 2000 Dot-Com Bust, and the 2008 Global Financial Crisis.

THE UNFORGIVING NUMBERS:

· 77% Historical Correlation: Post-cluster signals like this have preceded S&P 500 declines of 5-20% within 40 trading days, 77% of the time since 1962.

· The Breadth Collapse: While AI mega-caps hit record highs, the foundation crumbles. NYSE new lows have exploded to 2.5-5.1%, simultaneous with 4.6-14.4% new highs. The McClellan Oscillator has plunged to -171, signaling deep internal erosion.

· The $6 Trillion Sword of Damocles: A standard 10% correction equates to a $4-6 TRILLION evaporation of equity wealth, instantly vaporizing retirement accounts and institutional capital.

THE PARADIGM SHIFT:

This is not a "pullback." This is a phase transition from AI-driven euphoria to a market-wide reckoning. The signal indicates a fatal disconnect: a handful of stocks are masking a systemic rot beneath the surface. The VIX's complacency below 20 is a trap.

SURVIVAL PROTOCOL - THE 40-DAY COUNTDOWN:

· IMMEDIATE ACTION: Trim high-beta tech and cyclicals. Raise cash aggressively.

· NON-NEGOTIABLE HEDGE: Accumulate VIX calls or SPY puts on any strength. This is portfolio insurance.

· ROTATE OR PERISH: Shift to defensives, quality cash flows, and assets uncorrelated to equity frenzy.

THE KILL SWITCH:

This signal is falsifiable. If the S&P 500 does NOT experience a >7% drawdown by January 31, 2026, the Omen fails. Invalidation triggers are a VIX sustained below 20 and a positive McClellan Oscillator reversal by November 20.

The market's nervous system just flashed a code red. The next 40 days will define the next 40 months. Ignore this at your existential peril.

3.93K

THE SILENT APOCALYPSE: Bitcoin's $110K Mirage Masks The Largest Wealth Transfer In Human History

While you slept, the architecture of money died.

Bitcoin sits at humanity's crossroads, dismissed and mocked while trading sideways at $110K. Behind the "boring" 16% gain lies a seismic truth. 350 TRILLION dollars in global debt is collapsing into 21 million scarce coins. This is not speculation. It is thermodynamics.

THE NUMBERS THAT SHATTER WORLDS

Gold is up 46% in 2025. Nvidia is up 134%. Bitcoin appears flat. But here is the earthquake. 900 BILLION dollars in institutional inflows met zero supply response. BlackRock holds over 800,000 BTC. Michael Saylor’s Strategy holds over 640,000 BTC. Even China, which banned Bitcoin, hoards 190,000 BTC coins. Governments know what you do not. Scarcity is the only sovereign hedge when money printers run infinite.

December's Fed liquidity thaw combined with the US China truce has activated the detonation sequence. Bitcoin's correlation to Nasdaq has dropped from 0.7 to 0.2. Bitcoin has decoupled from traditional risk. It is not following stocks anymore. It is rewriting the rules.

THE BRUTAL TRUTH

Every sideways day at $110K is accumulated undervaluation. The mining floor is $55K. Fair value models point to $150K to $180K by year end. When correlation re syncs, when the fog clears, when institutions rotate back, this will coil like 1979 gold's 140% explosion.

WHAT THEY WILL NOT TELL YOU

You are watching the Byzantine Generals Problem solved in real time. A triple entry ledger that makes central banks obsolete. A Nash equilibrium where attacking costs 500 times more than defending. This is not just an asset. It is the thermodynamic separation of money from state control.

The shutdown ends. Data returns. Liquidity floods. And 159x dilution potential meets the hardest money ever created.

Survive or be left behind. The paradigm does not shift. It already shifted. You just have not felt the ground move yet.

The question is not if Bitcoin rallies. The question is whether you understood that money died and was reborn before the world noticed.

22.65K

BREAKING — THE METAL MIRAGE IS OVER: THE GLOBAL PRECIOUS METALS BUBBLE HAS POPPED

The trigger:

IMF and World Bank meetings two weeks ago reset global macro expectations. Within days, the largest synchronized metals reversal in a decade began.

The facts:

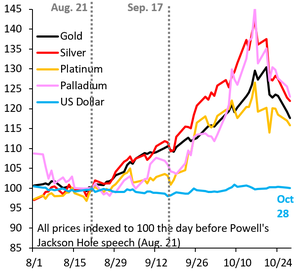

• Gold, silver, platinum, and palladium all peaked mid-October after a 30% rally since late August.

• Each collapsed 10-15% in under two weeks … a simultaneous detonation across the entire metals complex.

• The U.S. dollar index held steady, proving the inverse correlation that defines macro turning points.

• Capital is now migrating from defensive hard assets into productive U.S. equities and AI-driven sectors.

The hidden mechanism:

This wasn’t a routine correction … it was a policy-induced purge.

As central banks hinted at slower rate cuts and IMF panels backed a “strong dollar doctrine,” speculative metal longs were obliterated. Liquidity left the vaults and returned to the balance sheets of U.S. corporates.

The macro shockwave:

The world just witnessed the first coordinated unwinding of the “debasement trade.”

Gold’s fall isn’t a failure of faith … it’s a recalibration of reality: AI-led productivity, energy repricing, and a renewed U.S. growth premium have re-anchored global capital flows.

The takeaway:

The decade of hiding in hard assets is ending.

The next era will not be built on scarcity … it will be built on output, intelligence, and yield.

The precious metals bubble didn’t just burst.

It marked the moment markets stopped betting against the future of civilization.

Robin BrooksOct 28, 2025

The precious metals bubble is clearly bursting. The catalyst for this was the IMF/WB meetings 2 weeks ago, as I flagged in my post during the meetings. This is Dollar positive, because - underneath all this - people are going back to US exceptionalism...

48.75K

Top

Ranking

Favorites