Trending topics

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

jin

Contributor @Plasma 🕊️ | Writing about Stablecoins, Privacy & Machine Intelligence

Stablecoins must win.

912D63Nov 27, 01:14

Stablecoin adoption starts with education.

The Plasma Learn Center is your complete guide to digital dollars.

3.05K

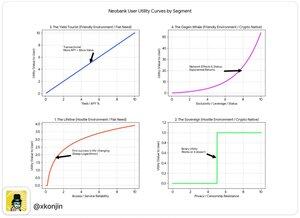

Most neobanks will fail and churn their incentives chasing linear utility curves.

The fundamental category error founders are making is treating Regulatory Friction (Location) and Liquidity Preference (Asset Class) as correlated variables.

They assume that high-friction environments equal low-sophistication users, or that friendly environments equal high-adoption mass markets.

Scraping data from social media across regions and user types shows they are generally orthogonal with p95.

If you map fiat vs crypto friendly zones against fiat:crypto liquidity ratio (how much crypto do you hold vs your fiat wealth) we uncover interesting data pointing to the true crypto neobank user archetypes.

The majority of neobanks you see live on the market today are in the top left, chasing linear utility curves (much loved by @SlackHQ founder @stewart) with the same offers and churning incentives with no real moat.

This only appeals to the "Yield Tourist" (Friendly Env / Low Crypto Net Worth).

These users are mostly mercenaries. Their loyalty is rented, not owned. As soon as a competitor offers a higher basis point or two on benefits, they churn.

You are likely optimizing for a linear curve (more features = more value) when your optimal user is on a logarithmic or exponential curve (basic access = 90% value or whales seeking status such as the Atlas / Amex black cohort).

Real crypto neobanks need to go back to basics and solve real problems for crypto natives.

Can i pay my mortgage with my crypto?

Can i pay for my direct debit with crypto?

Can i treat my crypto like money?

These questions are different depending on where you live and your wealth status.

In reality, only two products will win in the long term.

Product A: Optimizes for helping crypto natives in traditionally hostile environments. It is boring, invisible, and bulletproof. It serves the Hostile Quadrant. It solves hard problems.

Product B: Optimizes for Asset Efficiency and status. It is flashy, complex, and status driven. It serves the Friendly Quadrant. It gives people a better experience while allowing them to do more with their crypto.

Most lie in a no-mans land in the middle, not quite as good as a high street neobank like revolut or cashapp, but not able to be used to truly life off grid.

The true crypto neobank dream is half finished.

The company that verticalizes the stack, closes the loop with merchants and crypto holders while allowing them to spend their crypto like money for real life things will win.

@andrewchen 's work on Allele metrics for closing local loops with Uber is relevant here.

Return to crypto.

Give people freedom to live with their crypto.

Own your stack, close the loop, set people free.

Caveat: This is not a dig at current neobanks, we are so far ahead of where we were just a few years ago and this is a positive sum industry, we win together by overturning legacy systems.

Make no mistake, incumbents will shut down your accounts whether they accept stablecoins or not.

25.53K

Top

Ranking

Favorites